Gains tax is the tax levied on the profits gained from the transfer of ownership of capital Read this assets. It applies to all capital gains and varies depending on whether the gains are short-term or long-term. This tax can be reduced using tax-efficient financial strategies.

What are Capital Assets?

Capital assets, whether tangible or intangible, hold substantial value and are usually retained for the long term. They’re not meant for immediate resale but for extended use or investment. Now, let’s explore some common examples of capital assets:

Land

House property

Building

Types of Capital Gains Tax

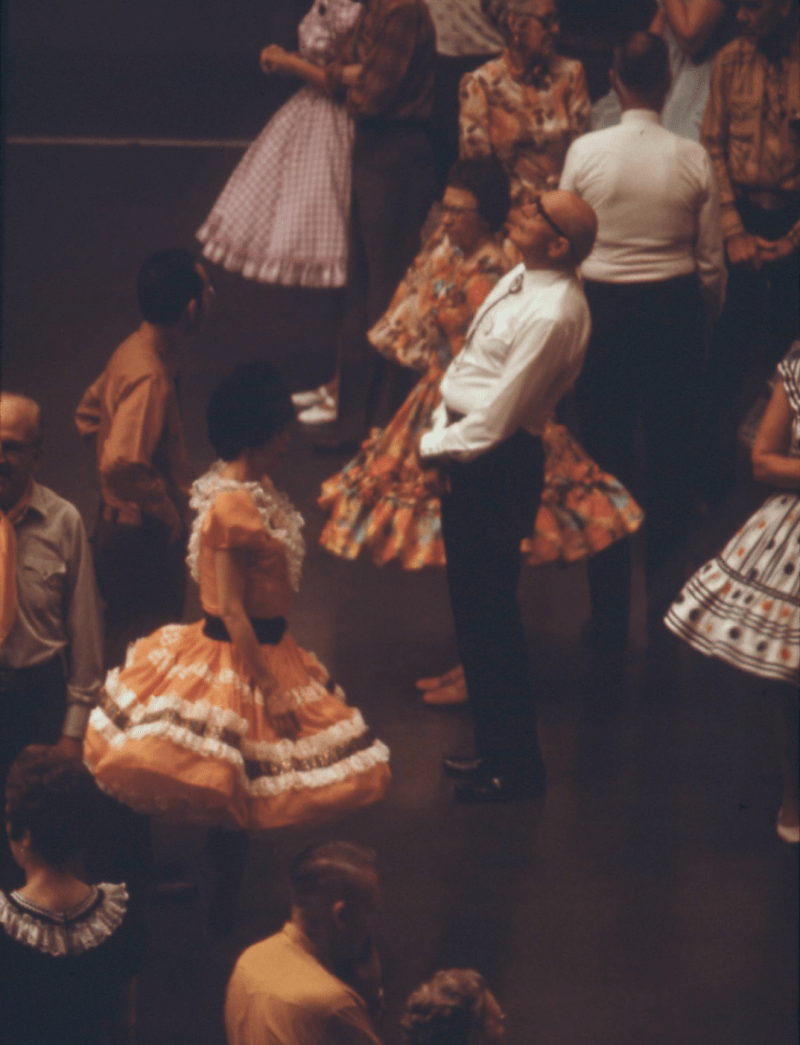

capital gain

- Short-term Capital Gain Tax (STCG)

Assets held for less than 36 months are considered short-term assets. For immovable properties, this duration is 24 months. Any profits generated from the sale of short-term assets are categorized as short-term capital gains and taxed accordingly.

- Long-term Capital Gain Tax (LTCG)

Assets held for more than 36 months fall under the category of long-term assets. Profits earned from the sale of long-term assets are treated as long-term capital gains and attract taxation accordingly. Assets such as preference shares, equities, UTI units, securities, equity-based mutual funds, and zero-coupon bonds are also considered long-term capital assets if held for over a year.